Nvidia Corporation’s stock jumped from $5.90 USD in January 2020 to $182 USD in August 2025. The company’s chips power artificial intelligence.

Artificial intelligence (AI) technologies have infiltrated most large companies and organizations in a euphoria of spending — businesses as varied as Sephora, Coca-Cola and Mercedes-Benz have incorporated AI in some way to cut costs, entice investments and attract customers. The pension world has not been free from this trend. While this technology creates interesting opportunities, it also carries with it significant risks.

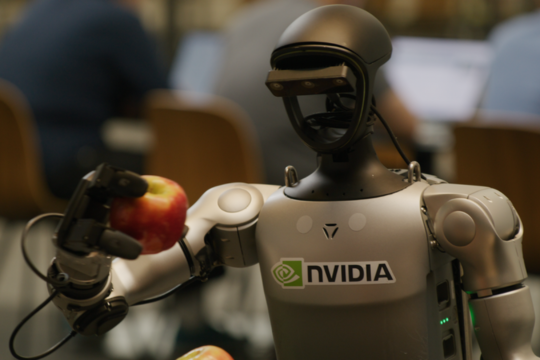

Stocks related to these technologies have exploded in popularity. To understand the amount of money that has been pumped into the AI market in a very short amount of time, you simply need to look at a single stock: Nvidia Corporation. The American technology company, which was mostly known for selling computer chips for video games, was trading in January 2020 at $5.90 USD. By August 2025, the price hit a new high of $182 USD. It became the first company to surpass $4 trillion USD in market capitalization — or eight per cent of the entire S&P 500 index. The reason? The chips it creates (GPUs) are what power AI technology.

Pension plans are investing in a big way — not just in equities such as Nvidia, but in physical assets. In July 2025, CPP Investments announced it had committed $225 million for a 50 per cent interest in a construction loan for a data centre in Ontario that has been pre-leased to a market-leading GPU-focused AI cloud-computing provider.

The bursting of the dot-com bubble in the early 2000s reminds us that there is risk in this elation. While the internet has been transformative, that didn’t necessarily translate into large permanent gains for investors of early internet stocks. The valuations and expectations of returns may not mesh with the amount of money being invested, which could lead to significant losses once the excitement cools.

Pension administrators have begun implementing AI to help in their actuarial assumptions and annuity pricing. They’ve also created member-focused tools such as chatbots to reduce repetitive inquiries and are using real-time AI monitoring of investments as opposed to more traditional annual reviews for members.

These use cases also bring risk — existing privacy legislation is applicable to regulation and use of AI, which means administrators must consider consent, disclosures, collect only the data that is necessary, include safeguards, etc. There is also a risk of intellectual property infringement and “AI hallucinations” where a large language model generates inaccurate data and presents it as fact.

AI technology is still in its infancy. There are reasons to be excited and anxious, but for better or worse, pension plans are jumping in with both feet.